How repaying your student loans can impact your finances

Written by Dawn Handschuh

Reviewed by Chris Conway, Director of Financial Education Initiatives and Repayment Management

Once youâve completed a degree program, you may feel relieved (to be done), elated (to have accomplished it) and excited (about the future). As you transition out of student mode, however, youâll need to begin repaying your student loans.

How responsibly you approach loan repayment can have a significant and long-lasting impact on your finances. Loan repayments can be especially challenging for adult learners who may already have a growing family, as well as a home and all the expenses that go along with that.Â

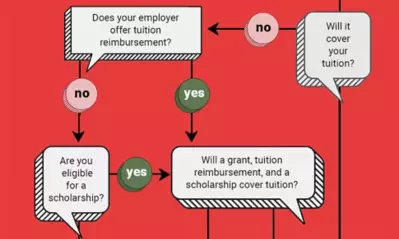

Itâs essential that adult borrowers have a financial plan so they know how theyâre going to pay for their education, explains Stacy Tucker, vice president of financial aid operations at °ÄÃÅĖėĖėēĘŋŠ―ąžĮž. âIdeally, your plan should include non-loan options for paying your tuition,â Tucker says. âAdopt the mindset that borrowing is the last option for whatever canât be paid through other means.â ââ

What happens when you make a late payment or skip a payment

When it comes to student loans, always pay the full amount due and always pay on time. If you canât, you have several options (weâll get to those in a minute), but donât ignore delinquency or default notices you get from your federal student loan servicer, which is the company that processes your loan repayments. (If youâre not sure who your loan servicer is, go to your dashboard at , and click on âView Detailsâ under the âMy Aidâ section.)

Once you miss a student loan payment, your loan is considered âpast due,â or delinquent. After 90 days of delinquency, your loan servicer will report the delinquency to the three national credit reporting bureaus: TransUnion, Experian and Equifax.

If you fall behind or skip repayments entirely, your loan goes into whatâs called default. This incurs a number of serious repercussions, including:

- Collection fees. You could be charged up to 25% of principal and interest on your loan; and, in the meantime, interest will continue to accrue.

- Garnishment of your paycheck.

- Money may be withheld from your income tax refund.

- Damaged credit makes it harder to get other types of consumer credit

Delinquency and defaulting on a student loan could also impact your credit score. This is important because your credit score comes from the data in your credit report. It helps lenders quickly determine whether youâre a good candidate for a loan, based on how likely it is that you will repay one. While there are several different credit scores, the FICOÂŪ Score is the industry standard. It can range from 300 to 850 with anything below 580 signifying a risky borrower, and anything over 800 considered exceptional.

Credit bureaus look at a variety of factors when determining your credit score, with payment history being the most important at about . Making payments on time can help improve your score.

Once loan servicers report loans to the national credit bureaus that are more than 90 days delinquent or in default, that negative information may remain on your credit report for as long as seven years, hindering your ability to qualify for the most favorable terms and interest rates on any future loans you may pursue, such as:

- A home mortgage

- An auto loan

- A credit card

- Additional student loans

Additionally, a lower credit score may impact your ability to set up utilities if you move to a new home, qualify for homeowner insurance or even get a cellphone, because all of these activities may require a credit check beforehand.

Late or defaulted loan payments could cost you a job or promotion

Many employers today perform a background check prior to making a job offer, although some states have limited that practice. If an employer does conduct a background check, it usually includes your credit report, so a delinquency or default reported on your student loan could reflect negatively on you.Â

Proactively monitor and safeguard your credit

There are steps you can take to monitor your credit and gain a better understanding of how your personal finances can affect your credit.

- Periodically check your credit report for errors or inaccuracies. You can dispute any mistakes, and youâre entitled to view a free credit report once a year at .

- You may choose to put a âfreezeâ on your credit to prevent any unauthorized or possibly fraudulent access to your credit report. If you plan to apply for a loan moving forward, you can temporarily lift the freeze so that a prospective lender can view your report.

- Many credit card issuers provide you access to your credit score at any time; by viewing it and your credit report, you can learn how your credit behaviors affect your score. On-time payments have a positive effect, as does having a long track record of responsible loan repayments.

You have options if youâre having trouble repaying your federal student loans

If youâre having trouble making payments, Tucker advises asking for help early on and contacting your federal student loan servicer to discuss your options. This should be done without delay, since once you have defaulted on a loan, these options are no longer available to you, including the option to change your payment plan to an .

Itâs also best to create an online account with your loan servicer, Tucker adds. This makes it easier to manage your federal student loans and ensures you have current and accurate information.

Four federal income-driven repayment plans are available, three of which have you pay 10% of your discretionary income. The Standard Repayment Plan has a 10-year term with fixed monthly payments designed to pay off your loan as quickly as possible, with the least amount of interest, but there are other term-based plans too. Try out the loan simulator at to compare plans and determine which is best for you. â

You might also consider or forbearance, both of which let you temporarily suspend payments. The drawbacks? Interest continues to accrue during forbearance and on unsubsidized loans during deferment.

Another option is to consolidate multiple federal student loans into a Direct Consolidation Loan, simplifying your repayment schedule. Be sure you understand the pros and cons of doing so. While there is no application fee, consolidation can increase the time it takes to pay off your loan, and may cost more in interest. You may also lose certain borrower benefits associated with your current loan.

If you have already defaulted on your federal student loan (that is, if your loan is more than 270 days past due), you can participate in the governmentâs program, which helps you choose an affordable repayment plan.

There are additional benefits to doing so:

- The default will be removed from your credit report.

- Youâll be able to apply for federal student aid again.

- Youâll halt collection calls, wage garnishment or withholding of any tax refunds or Social Security payments.

- Unfortunately, the options available to borrowers of private loans are quite limited, and private loan borrowers donât enjoy the same protections as borrowers of federal student loans. Private loan contracts vary, so read your loan contract very carefully to familiarize yourself with your loanâs conditions, rates, fees and penalties.

Itâs important to stay on top of your ongoing expenses and future debts. That oft-heard expression âliving like a studentâ means keeping your bills as low as possible â even when youâre done with school, Tucker says. âIf you know youâll have loans in the future, donât pile up too much debt that will make it difficult to pay.â Â

Remember, your ability to meet your financial obligations can ensure your familyâs financial security.

This article is not intended to serve as financial advice. All financial decisions, including investments, should be made carefully and potentially with the guidance of a financial planning professional.

ABOUT THE AUTHOR

Dawn Handschuh has been putting pen to paper for more than 30 years, writing widely on topics related to student lending, personal finances, everyday money management and retirement planning. She makes her home in Connecticut with her husband and two energetic German shepherds.

ABOUT THE REVIEWER

As Director of Financial Education Initiatives and Repayment Management, Chris Conway works with departments across the University to provide resources that allow students to make more informed financial decisions. She is also an adjunct faculty member for the Everyday Finance and Economics course at the University, and she chairs the National Council of Higher Education Resources College Access and Success Committee. Conway is committed to helping college students make the right financial decisions that prevent future collection activity.

This article has been vetted by °ÄÃÅĖėĖėēĘŋŠ―ąžĮž's editorial advisory committee.Â

Read more about our editorial process.

Read more articles like this: